August 2023

Monthly Market Update

Macro Update

-

- The month began with a downgrade of US government debt by Fitch, the second of the ‘big 3’ rating agencies to do so (after S&P in 2011). Fitch cited growing government debt and a deterioration in standards of governance as reasons for the downgrade.

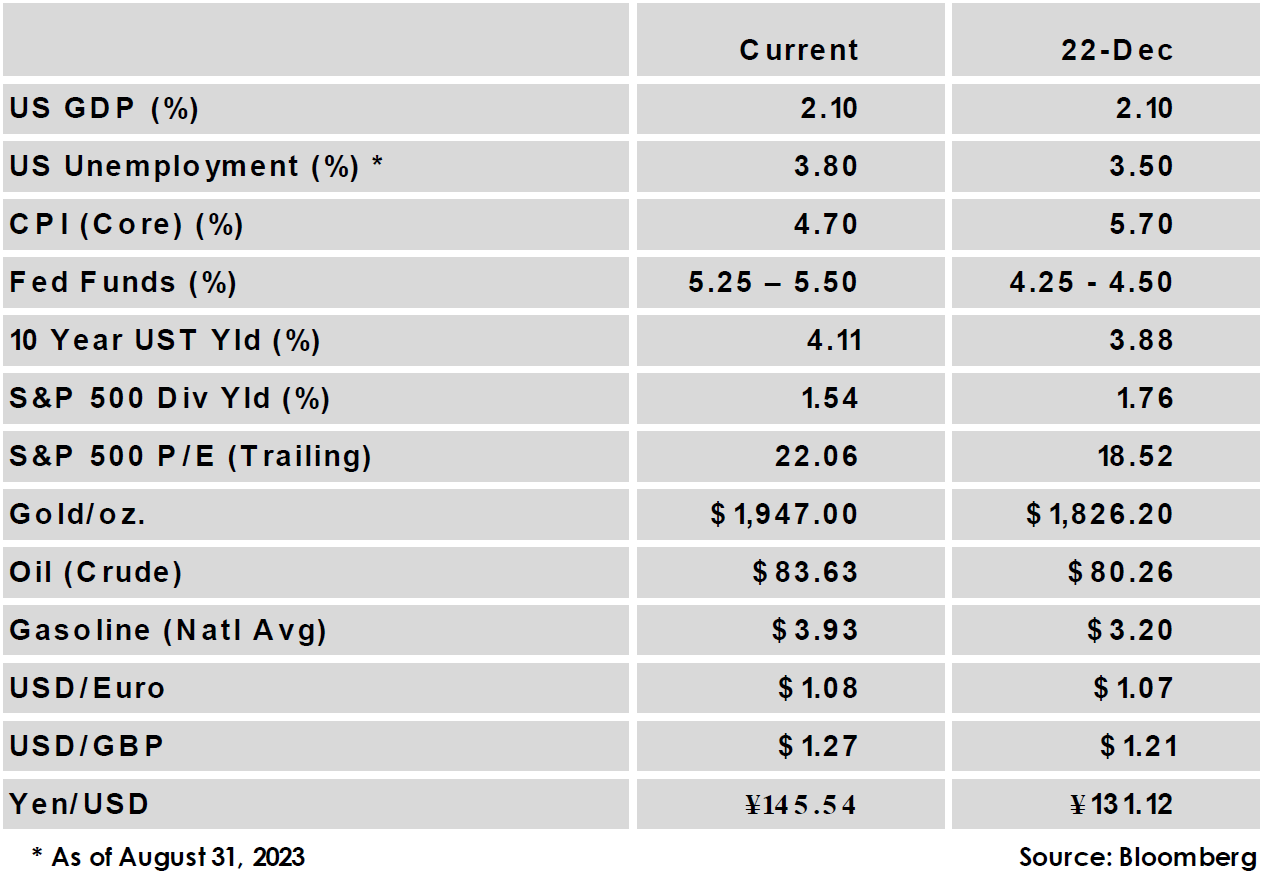

- The US jobs market is increasingly showing signs of cooling, with both the number of job openings and the quits rate decreasing. Other economic data was mixed as manufacturing activity as measured by PMI was below expectations, but personal spending rose 0.8% month-over-month, higher than expected.

- Headline CPI came in below expectations at a 3.2% gain from one year ago. However, producer prices rose more than expected, rising to a 0.8% annual gain and up from 0.2% in the prior month. Higher energy prices will present an upside risk to inflation in the coming months.

- China’s growth continued to disappoint, with a decline in trade, continued weakness in the property sector, and the economy slipping into deflation.

- The month began with a downgrade of US government debt by Fitch, the second of the ‘big 3’ rating agencies to do so (after S&P in 2011). Fitch cited growing government debt and a deterioration in standards of governance as reasons for the downgrade.

Global Equity

-

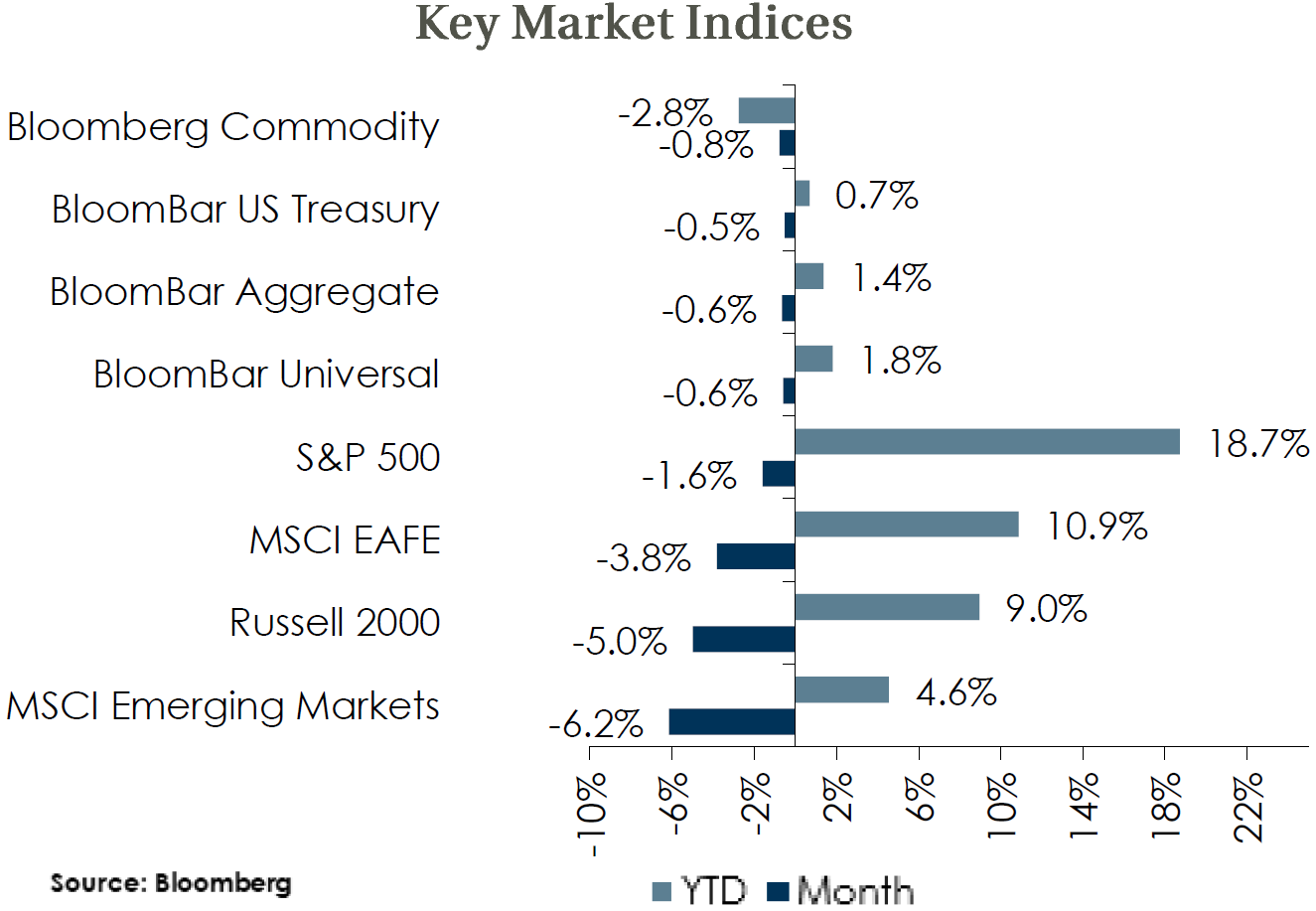

- Slowing global growth and the downgrade of US debt hurt investor sentiment and sent equities lower for most of the month. However, equities recovered some of their losses by month-end as moderating jobs and inflation data led investors to bet the Fed was done hiking rates.

- Valuations on forward earnings declined but still sit at or above average across equity indices and valuations on US large caps remain stretched. With Q2 S&P 500 earnings nearly 100% reported, earnings are down 4.1%, the third consecutive quarter of earnings declines.

- One-year forward earnings estimates forecast only modest growth but are trending higher, aligning with the prevailing view of weaker global growth ahead but with a downturn that is relatively mild and short in duration.

- Slowing global growth and the downgrade of US debt hurt investor sentiment and sent equities lower for most of the month. However, equities recovered some of their losses by month-end as moderating jobs and inflation data led investors to bet the Fed was done hiking rates.

Global Fixed Income

-

- US Treasury yields moved higher across most of the curve as traders continue to assess the path of the Fed and as the US debt downgrade impacted sentiment around treasury debt.

- Yields also reacted to the Fed’s Jackson Hole Symposium, which introduced no new policy but saw bankers stress that interest rates will remain high until inflation has returned to target.

- Credit spreads rose slightly with investment grade rising 6 bps and high yield 5 bps higher, although both assets outperformed equities for the month thanks to supportive yields.

- US Treasury yields moved higher across most of the curve as traders continue to assess the path of the Fed and as the US debt downgrade impacted sentiment around treasury debt.

Global Real Estate

-

- Core real estate returns delivered a third consecutive quarter of negative returns in the second quarter, while the appreciation component of returns had its fourth consecutive negative quarter.

- Real estate returns could continue to be challenged amid higher interest rates, tighter lending conditions, and reduced demand for office space.

- Core real estate returns delivered a third consecutive quarter of negative returns in the second quarter, while the appreciation component of returns had its fourth consecutive negative quarter.

|

|

Disclosures and Legal Notice | © 2023 Asset Consulting Group. All Rights Reserved.