August 2024

Monthly Market Update

Macro Update

-

- A surprisingly weak labor market report contributed to concerns about the overall direction of the economy, leading to a bout of intra-month volatility in equity prices and credit spreads that calmed by month-end.

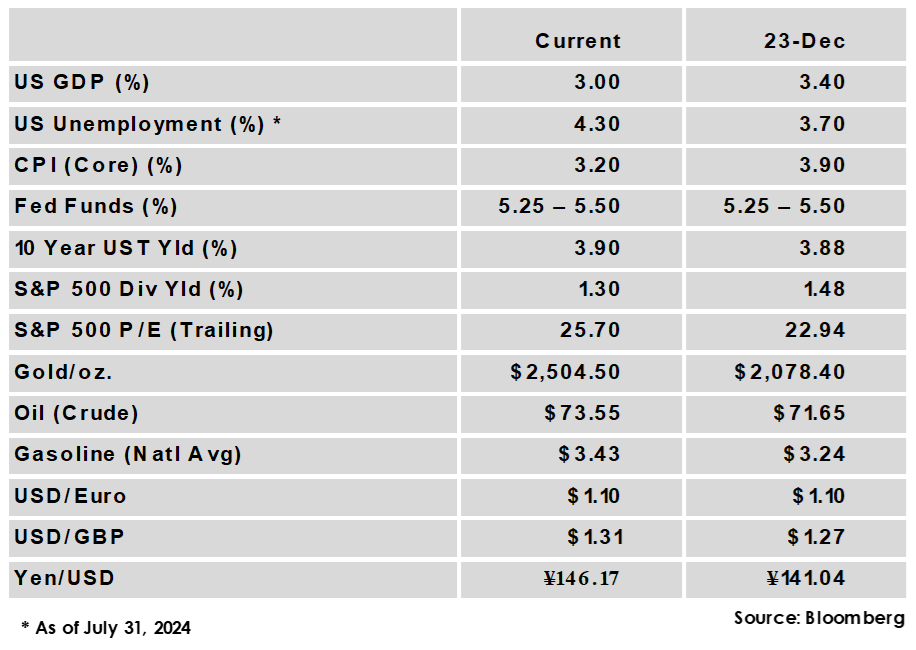

- Nonfarm payrolls added just 114,000 jobs in July and the unemployment rate increased to 4.3%. Additionally, average hourly earnings increased a modest 0.2% on the month and 3.6% for the prior 12 months, the lowest rate since May 2021.

- Beyond labor data, economic indicators were supportive of market sentiment in August. 2nd quarter GDP growth was revised upwards from 2.8% to 3.0%, and retail sales surged by 1% month-over-month, much better than expected.

- Inflation results were in-line with estimates, with headline CPI rising 2.9% for the trailing 12 months, the smallest increase since March 2021.

- A surprisingly weak labor market report contributed to concerns about the overall direction of the economy, leading to a bout of intra-month volatility in equity prices and credit spreads that calmed by month-end.

Global Equity

-

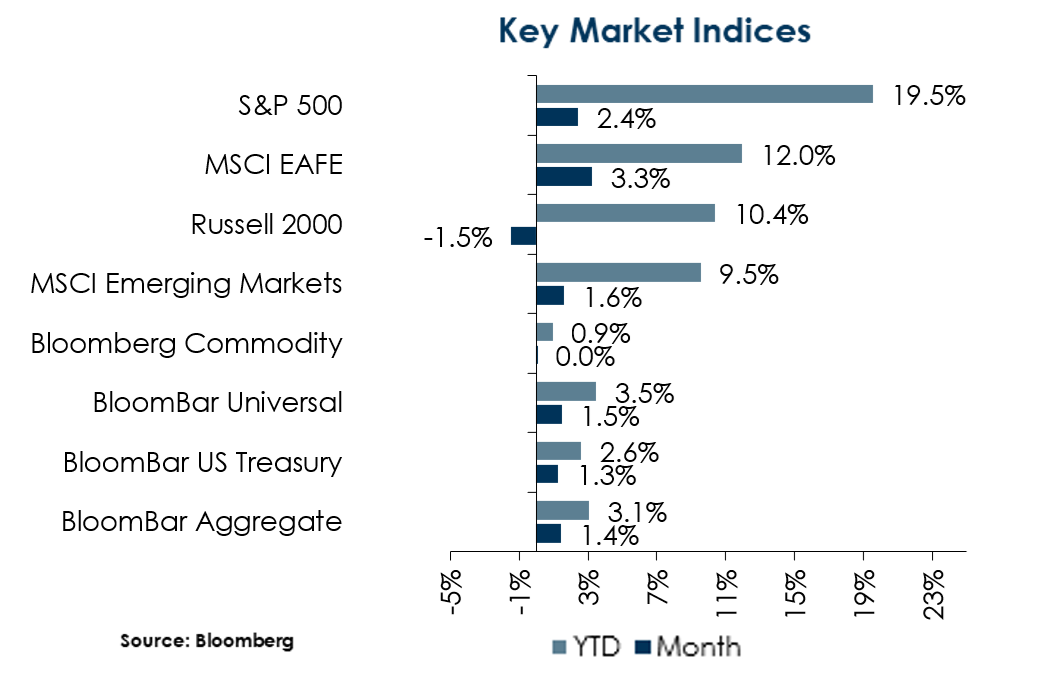

- Equity markets moved mostly higher in August after recouping losses from an early month drawdown. A weaker US dollar helped international developed equities lead among broad indices while US small caps lagged. The S&P 500 was briefly down more than 7% before recovering to a positive return by month-end.

- 2nd quarter earnings results from the S&P 500 have been supportive of equity prices, with the final growth rate projected to be 13%, the best results since 2021.

- Solid earnings and AI enthusiasm remain supportive of US large caps, but August’s volatility highlighted the extent to which equities have been priced for a soft landing, leaving them vulnerable to downside surprises. Markets will continue to grapple with uncertainty around policy, economic growth, and AI profitability.

- Equity markets moved mostly higher in August after recouping losses from an early month drawdown. A weaker US dollar helped international developed equities lead among broad indices while US small caps lagged. The S&P 500 was briefly down more than 7% before recovering to a positive return by month-end.

Global Fixed Income

-

- US treasury yields trended lower with the largest declines on the front end of the curve. The 2-year yield dropped 34 bps to 3.92% while the 10-year rate fell 13 bps to 3.90%, leaving the 2-year/10-year inversion at just -2bps, its steepest point since July 2022.

- Fed Chair Jerome Powell signaled an impending shift to easier monetary policy, and current market pricing treats a September cut as a certainty. While cash has provided attractive yields for the last two years, cash rates are set to fall as the interest rate cutting cycle begins.

- Credit spreads experienced significant volatility only to end roughly where they began, with IG spreads unchanged and HY spreads 9 bps tighter. Spread levels leave little room for further contraction, but corporate fundamentals are healthy and will benefit from lower rates.

- US treasury yields trended lower with the largest declines on the front end of the curve. The 2-year yield dropped 34 bps to 3.92% while the 10-year rate fell 13 bps to 3.90%, leaving the 2-year/10-year inversion at just -2bps, its steepest point since July 2022.

Global Real Estate

-

- Returns for core real estate were negative as market values declined for the eighth consecutive quarter. However more sectors turned positive this quarter as all property types except offices produced positive returns, with office demand continuing to struggle to adapt to post-pandemic work arrangements.

- Cap rates remain under upward pressure in an environment of increased and sticky bond yields. The commercial real estate market is also bracing for a potential surge in loan defaults as existing loans mature and borrowers are forced to refinance at sharply higher rates.

- Returns for core real estate were negative as market values declined for the eighth consecutive quarter. However more sectors turned positive this quarter as all property types except offices produced positive returns, with office demand continuing to struggle to adapt to post-pandemic work arrangements.

|

|

Disclosures and Legal Notice | © 2024 Asset Consulting Group. All Rights Reserved.