Monthly Market Update

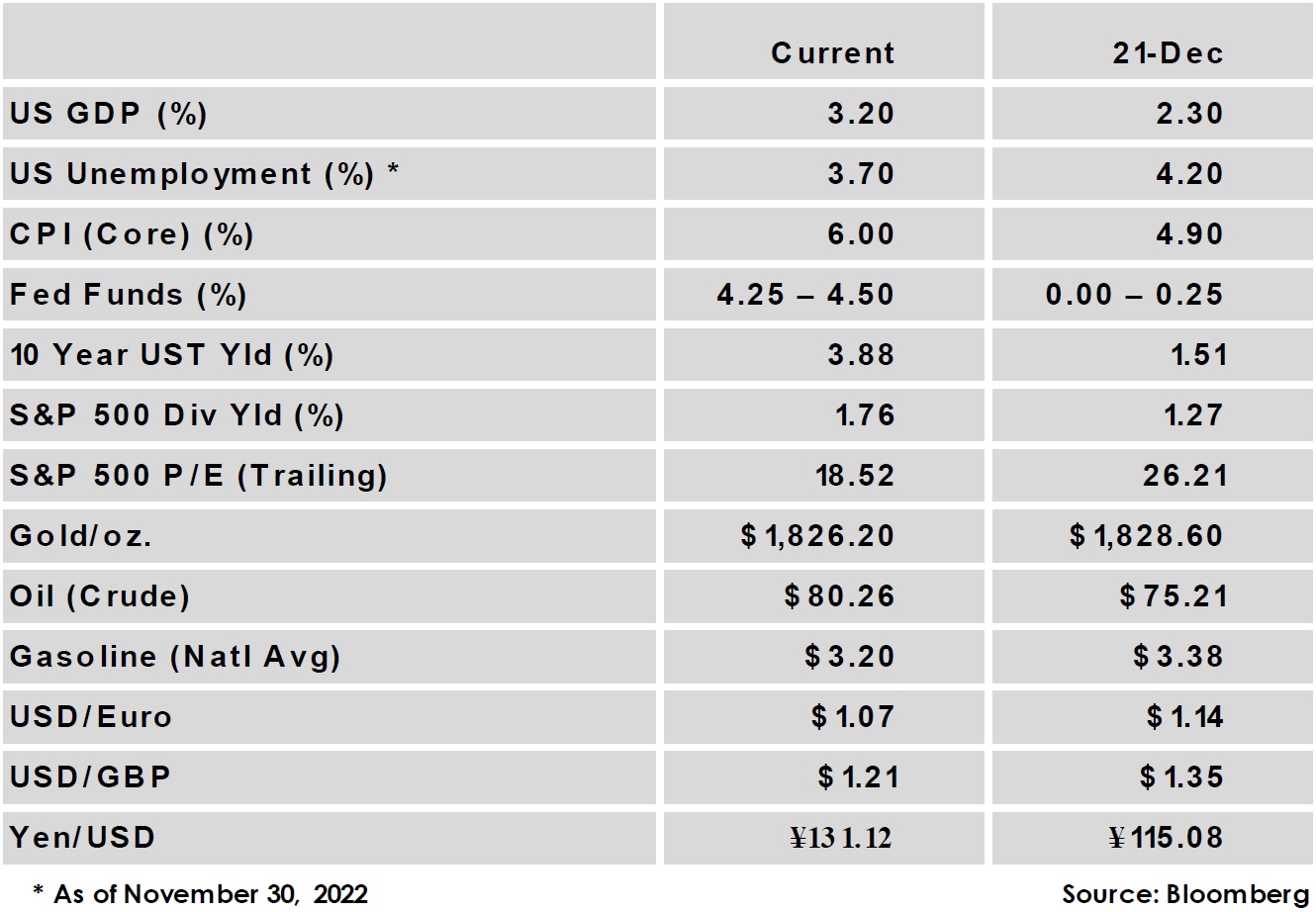

A challenging year for financial markets ended on a down note as equity markets declined with rising rates, partially reversing what was a generally positive final quarter of 2022. Inflation continued to show signs of having peaked, with headline CPI coming in well below expectations at 7.1% for the trailing 12 months. The US Federal Reserve followed this with a widely expected 50 bps hike, a slowdown from the pace of prior hikes. Market sentiment turned negative, however, on the corresponding release of the Fed’s updated dot plot, which showed a terminal rate 50 bps higher than the September projection.

While the labor market remained strong other economic data pointed to a slowing economy, with retail sales falling in November, US manufacturing PMI registering its first contractionary reading since the pandemic’s outset, and the US leading economic indicator index declining for a ninth consecutive month. The current market outlook predicts a further slowing of the pace of hikes from the Fed to a 25 bps hike in February, with an expectation of a pause near 5% in the early months of 2023. Fed guidance has suggested a preference to keep rates on hold for some time following, but the actual path will continue to depend greatly on inflation and the labor market.

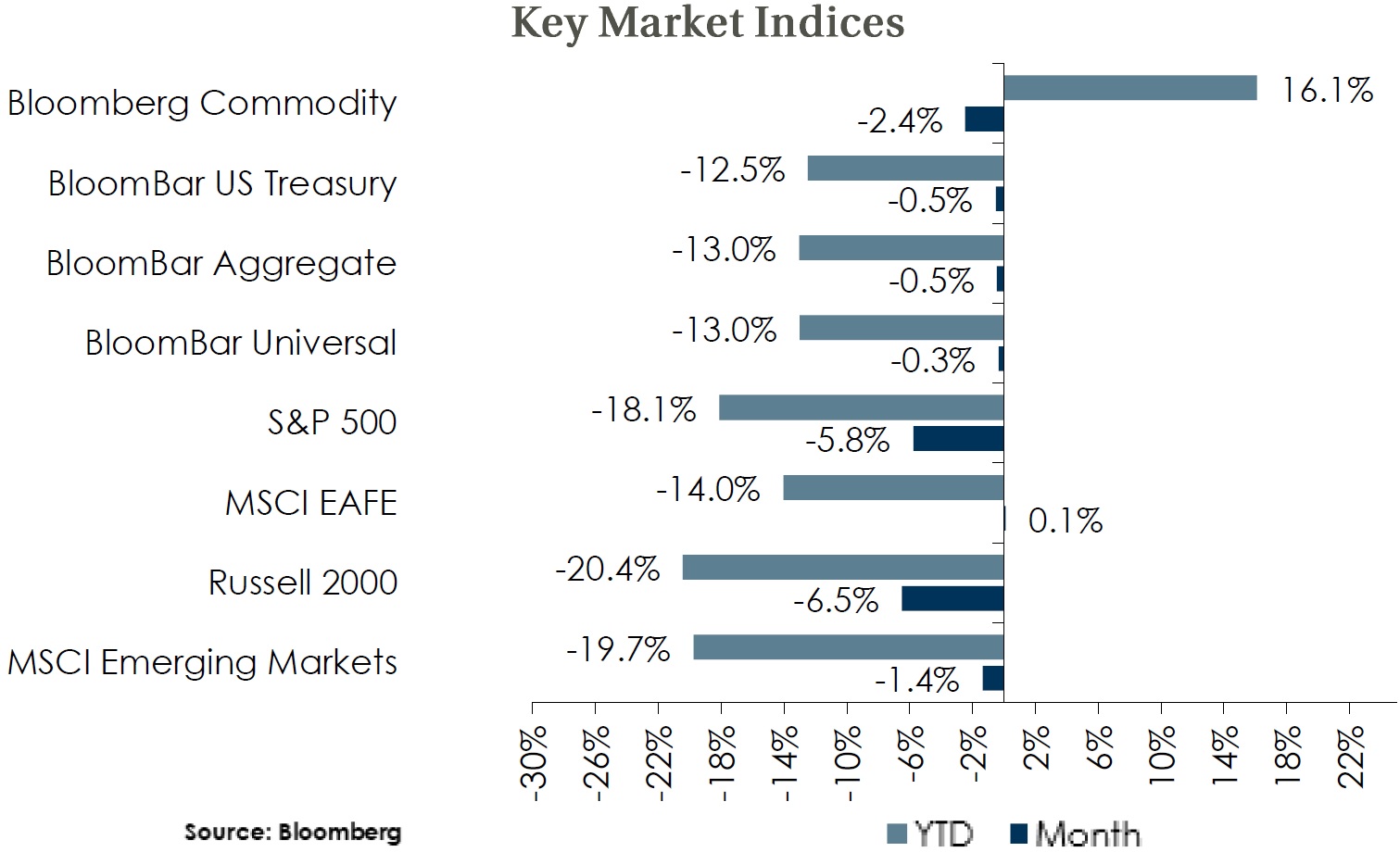

- Global Equity – Equity indices were mostly lower in December, with US markets faring worse than Non-US as the US dollar continued to weaken. International developed equity outperformed with a flat return and emerging markets were modestly negative, supported by Chinese equities continuing to rebound after the zero-Covid policy reversal. Equity market volatility is likely to continue given central bank policy uncertainty, geopolitical conflict, and market adjustments to China’s policy changes following three years of lockdown. Valuations on forward earnings fell in December and still sit near neutral levels. Earnings growth has weakened overall across regions, but forecasts for Non-US developed regions have turned higher in recent months, and currency could continue to be a tailwind for international equities.

- Global Fixed Income – Global bond yields rose in December, with much of the increase following the Fed’s release of an updated dot plot showing a higher terminal rate. Japan also caught markets off-guard with a tweak to its yield curve control policy, which resulted in the 10-Yr JGB yield hitting its highest level since 2015. Credit spreads were mixed in the month as high yield moved 21 bps wider and IG credit 3 bps tighter, and strong fundamentals should favor IG credits over high yield in a slowing economy. The 10-year UST yield rose 27 bps, and core bond yields remain elevated relative to recent history. Volatility in rates and currency can provide enhanced opportunities for absolute return strategies, but credit exposure and a lower duration could hurt returns relative to cash and core bonds. A cash allocation provides portfolio flexibility while higher yields have improved the asset’s return potential.

- Global Real Estate & Private Equity – Core real estate returns cooled significantly from recent quarterly performance but maintained a modestly positive return. In a change, Hotels replaced Industrials as the top performing sector in the quarter, and Office was the only sector with negative performance. Real estate returns could continue to be challenged as higher interest rates put upward pressure on cap rates, which currently sit near historic lows. New deal activity in private equity continues to slow from 2021’s elevated rate but overall remains at healthy levels.

Disclosures and Legal Notice (Opens in a new Window) | © 2022 Asset Consulting Group. All Rights Reserved.