July 2023

Monthly Market Update

Macro Update

-

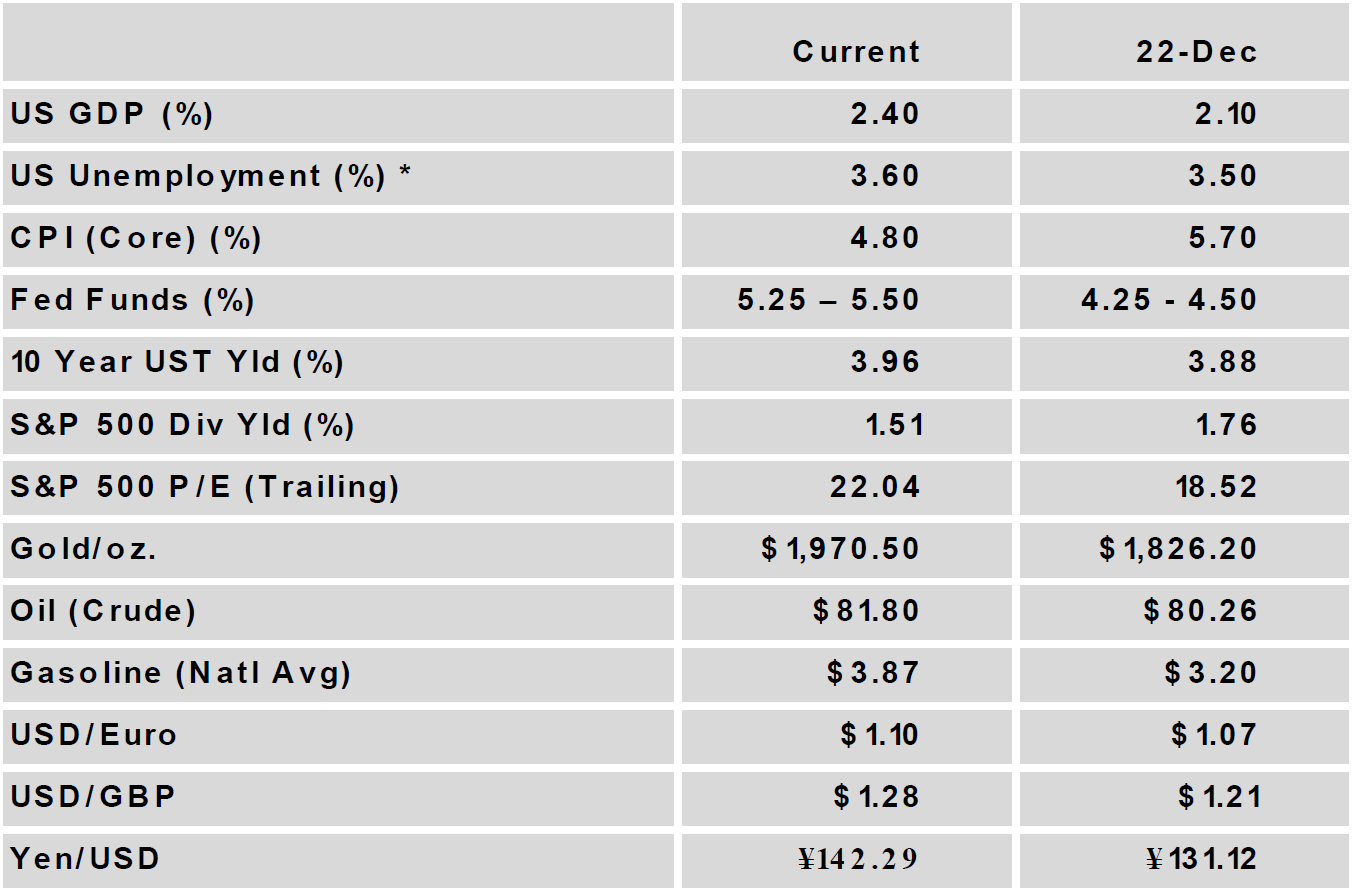

- Inflation remains elevated but further moderated in July across most global economies, including a lower than expected 3% rate for US headline CPI. The declines boosted sentiment and led to speculation that the Fed and other developed market central banks were nearing the end of their tightening cycles.

- The Fed raised its policy rate by 25 bps to 5.25% - 5.50%, as expected. Futures pricing suggests market participants view this as the final rate increase of this cycle, but Fed Chair Jerome Powell indicated that the committee remains data dependent and additional hikes may be warranted.

- US economic data continued to show resilience, as 2nd quarter GDP exceeded expectations with an estimated 2.4% annualized growth rate, reflecting ongoing strength in consumer spending and the best growth in business investment in over a year.

- Economic growth in Europe continued to disappoint, with Eurozone manufacturing activity slumping to its lowest level since early 2020.

- Inflation remains elevated but further moderated in July across most global economies, including a lower than expected 3% rate for US headline CPI. The declines boosted sentiment and led to speculation that the Fed and other developed market central banks were nearing the end of their tightening cycles.

Global Equity

-

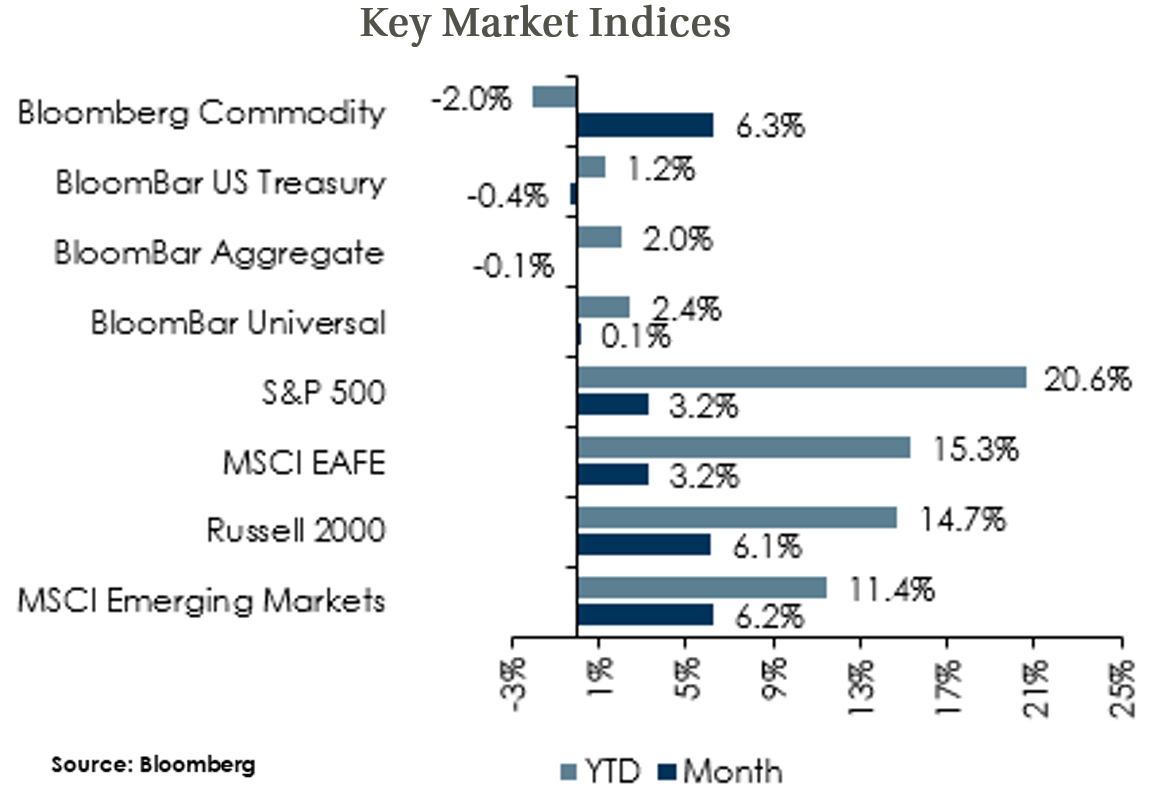

- Positive economic data in the US and moderating inflation led equities to maintain their momentum for another month of strong returns in July.

- Valuations on forward earnings rose and now sit above median for most equity indices. US Large Caps in particular have seen valuations become stretched as economic data has surprised to the upside and excitement over AI has buoyed tech stocks.

- One-year forward earnings estimates forecast only modest growth but are trending higher, given the prevailing outlook for weaker global growth but with any downturn expected to be relatively mild and short in duration.

- Positive economic data in the US and moderating inflation led equities to maintain their momentum for another month of strong returns in July.

Global Fixed Income

-

- US Treasury yields moved slightly higher across most of the curve as economic data surprised to the upside. Short term treasury bill returns exceeded 4% for the trailing one-year for the first time in 15 years.

- Sovereign yields generally moved higher as many developed market central banks further tightened policy, including a surprise relaxation of yield curve control from Japan. As in the US, however, forward guidance from global central banks has become less definite and additional tightening is no longer a certainty.

- Credit spreads declined in the month with investment grade falling 11 bps and high yield 23 bps lower. Spreads are becoming tight relative to recent history, but fundamentals remain solid and yields for corporate bonds remain quite attractive.

- US Treasury yields moved slightly higher across most of the curve as economic data surprised to the upside. Short term treasury bill returns exceeded 4% for the trailing one-year for the first time in 15 years.

Global Real Estate

-

- Core real estate returns were negative for a third consecutive quarter in Q2, while the appreciation component of returns had its fourth consecutive negative quarter.

- Real estate returns could continue to be challenged amid higher interest rates, tighter lending conditions, and reduced demand for office space.

- Core real estate returns were negative for a third consecutive quarter in Q2, while the appreciation component of returns had its fourth consecutive negative quarter.

|

|

Disclosures and Legal Notice | © 2023 Asset Consulting Group. All Rights Reserved.