May 2024

Monthly Market Update

Macro Update

-

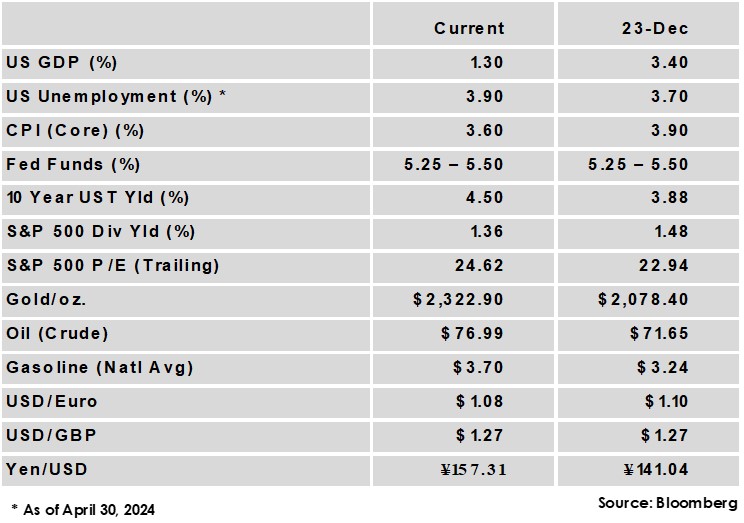

- May brought relief to 2024’s string of hotter than expected inflation reports, with measures of consumer inflation at or slightly below expectations. Core CPI’s year-over-year increase fell from 3.8% to 3.6% while core PCE, the Fed’s preferred gauge, held at 2.8%.

- The 2nd estimate of US GDP showed the US economy grew at an annualized pace of 1.3% in the 1st quarter, down from the first reading of 1.6% growth. Monthly data beyond March generally points to continued expansion, and the Atlanta Fed's GDP model is currently projecting 1.8% growth in the 2nd quarter.

- In another sign of moderating economic growth, US consumer spending declined 0.1% when adjusted for inflation, reflecting a sharp decline in goods spending.

- April’s jobs data was softer than expected, with the US economy adding 175,000 jobs and unemployment ticking up from 3.8% to 3.9%.

- While still lagging that of the US, the Eurozone’s economy has shown signs of life recently with the bloc’s composite PMI rising to its highest level in a year.

Global Equity

-

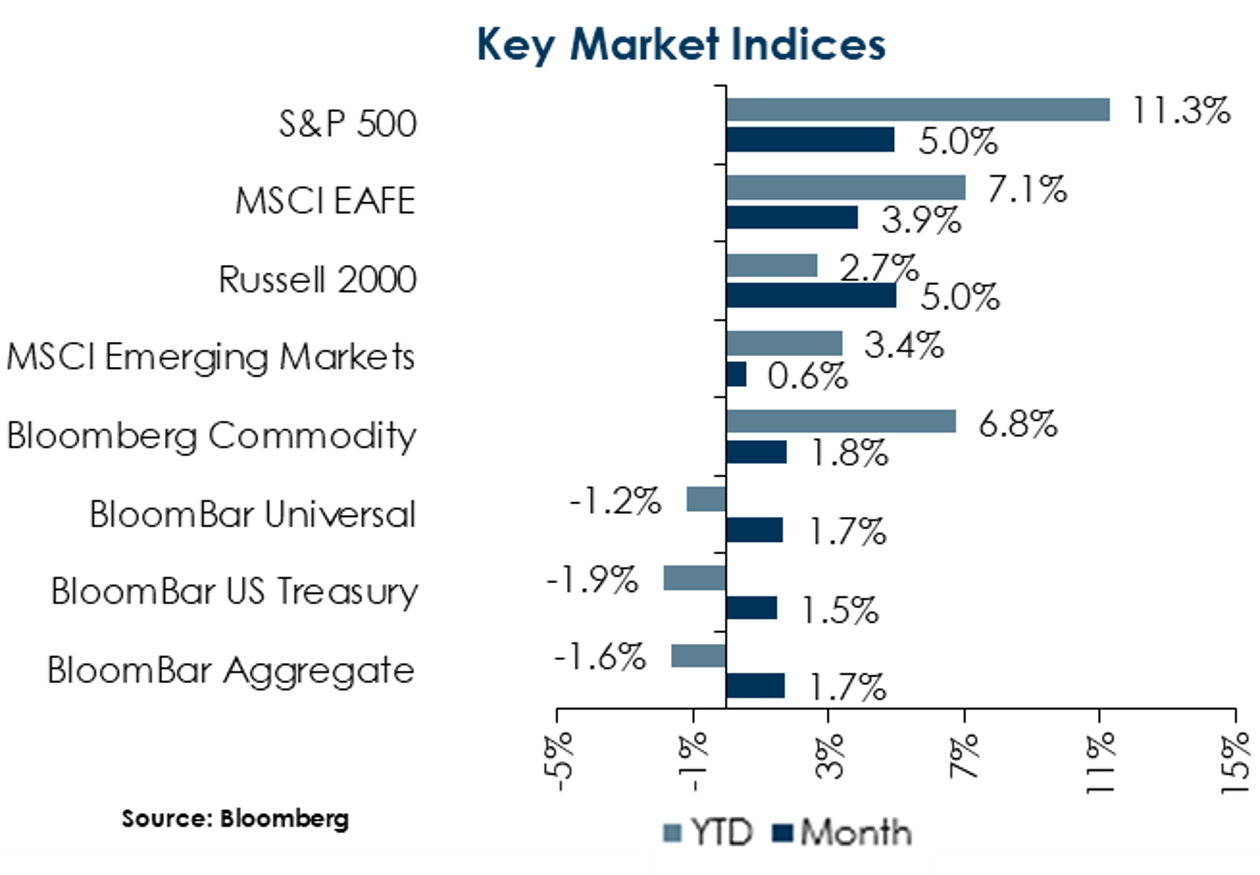

- Equity markets rebounded in May as cooling inflation improved investor sentiment. Most broad equity indices were positive on the month, though emerging markets significantly lagged developed markets.

- With nearly all of the first quarter’s earnings reported, 78% of S&P 500 companies have reported a positive earnings surprise. The year-over-year earnings growth rate of 5.9% is the highest since Q1 of 2022.

- Valuations on forward earnings remain stretched for US large caps but are near average for other indices. Robust earnings growth around the AI theme could continue to propel US equities in the near-term, while impending central bank policy easing and improving growth in Europe help support Non-US equities.

Global Fixed Income

-

- US treasury yields fell across the curve in May amid easing inflation and softening economic data, with the 10-year US Treasury yield falling 18 bps to 4.50%.

- No action on interest rates is expected at the June Fed meeting, with market pricing now projecting a September start to rate cuts at the earliest. The European Central Bank and Bank of England appear on track to start easing ahead of the Fed, with an ECB cut expected in June.

- Credit spreads were little changed in the month, with high yield corporate spreads 7 bps wider and IG spreads 2 bps tighter. Both measures are near the bottom of their historic ranges, but the economic backdrop remains supportive of credit and all-in yields are attractive relative to recent history.

Global Real Estate

-

- Core real estate continued its losing streak with a 6th straight quarter of negative returns in 1Q. Property values were down across every property type, with Office assets once again the worst performer with -5.0% depreciation.

- Cap rates remain under upward pressure in an environment of increased and sticky bond yields. Office continues to be the most troubled sector, and the full effect of post-pandemic work arrangements will continue to play out as office leases come up for renewal.

|

|

Disclosures and Legal Notice | © 2024 Asset Consulting Group. All Rights Reserved.