October 2024

Monthly Market Update

Macro Update

-

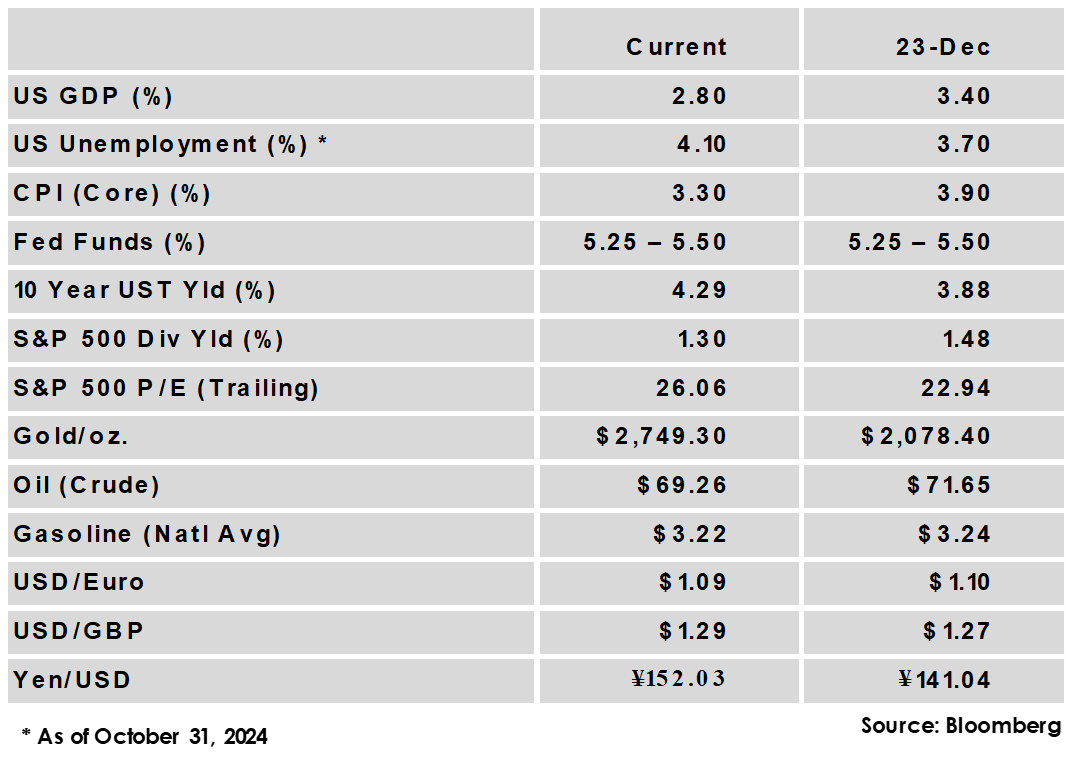

- US GDP grew at a 2.8% annualized rate in the 3rd quarter, slightly behind estimates of around 3% but a robust result overall. While the Federal Reserve recently kicked off rate cutting with a 50 bps cut, the strong GDP figure suggests a reduced 25 bps cut is more likely for the November meeting.

- Nonfarm payrolls exceeded expectations in September, adding 254,000 jobs while the unemployment rate ticked down to 4.1%, the second monthly decline since hitting 4.3% in July. These figures eased concerns around the labor market and likely help push the Fed towards a more gradual pace of cuts.

- Inflation was higher than expected, with Core CPI rising from 3.2% to 3.3% while Core PCE held steady at 2.7% for the third consecutive month.

- Euro area GDP hit a two year high, beating expectations with 0.4% quarterly growth. Germany, Europe’s biggest economy, avoided a widely forecast recession with 0.2% quarterly growth. The higher than expected output should ease pressure on the European central bank to accelerate rate cutting.

- US GDP grew at a 2.8% annualized rate in the 3rd quarter, slightly behind estimates of around 3% but a robust result overall. While the Federal Reserve recently kicked off rate cutting with a 50 bps cut, the strong GDP figure suggests a reduced 25 bps cut is more likely for the November meeting.

Global Equity

-

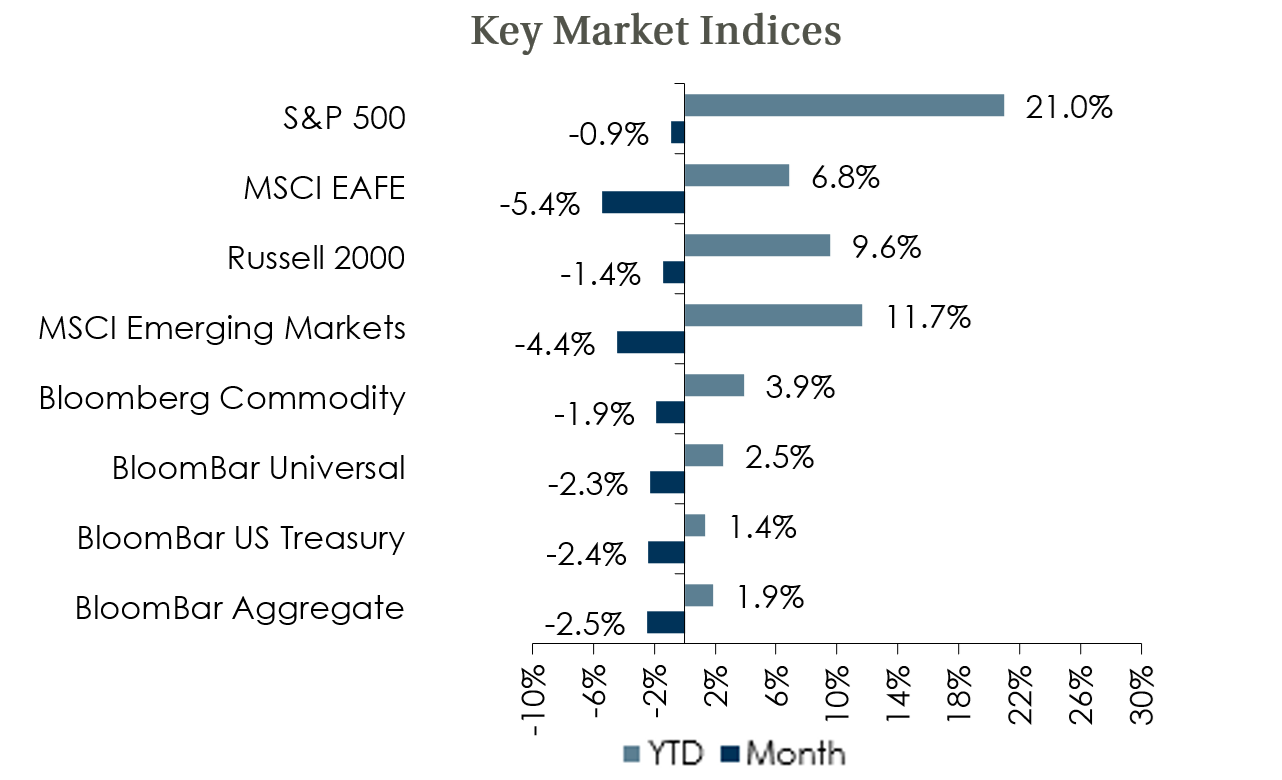

- Equity markets declined in October with heightened volatility. US markets outperformed non-US and US large caps led overall. US dollar strength was a significant drag on non-US equity returns, subtracting nearly 400 bps of return from international developed markets for US investors in the month.

- Global economic growth remains mixed, with the US looking likely to avoid recession while growth in Europe remains sluggish. Coordinated policy easing across most major economies should help stabilize the global growth outlook and support equity markets.

- Valuations for US equities, particularly large caps, are stretched but solid earnings and sentiment are positive drivers. Non-US valuations are fair but the more challenged macro outlook limits upside.

- Equity markets declined in October with heightened volatility. US markets outperformed non-US and US large caps led overall. US dollar strength was a significant drag on non-US equity returns, subtracting nearly 400 bps of return from international developed markets for US investors in the month.

Global Fixed Income

-

- US treasury yields sharply reversed recent declines, with the 10-year rising 50 bps in the month as markets recalibrated the expected pace of Fed rate cutting following employment and inflation data. Concerns that policy under the next president would further raise the national debt also pressured rates higher.

- Rate volatility rose in October given uncertainty around the pace and magnitude of rate cuts along with policy uncertainty ahead of the election. Yields appear likely to continue to experience large swings based on incoming data.

- Credit spreads ground tighter in October, with IG spreads 5 bps tighter and HY spreads 13 bps tighter. Current spread levels leave little room for further contraction, but total income remains relatively attractive and the strong US economy supports corporate fundamentals.

- US treasury yields sharply reversed recent declines, with the 10-year rising 50 bps in the month as markets recalibrated the expected pace of Fed rate cutting following employment and inflation data. Concerns that policy under the next president would further raise the national debt also pressured rates higher.

Global Real Estate

-

- Returns for core real estate were positive in the 3rd quarter for the first time since the 3rd quarter of 2022. Property values still declined modestly, but the income component of returns more than made up the difference to generate a positive return overall. All sectors but Offices produced positive returns in the quarter.

- Cap rates have been under upward pressure in an environment of increased and sticky bond yields. With borrowing rates stabilizing and likely to fall, real estate transaction activity is picking up.

- Returns for core real estate were positive in the 3rd quarter for the first time since the 3rd quarter of 2022. Property values still declined modestly, but the income component of returns more than made up the difference to generate a positive return overall. All sectors but Offices produced positive returns in the quarter.

|

|

Disclosures and Legal Notice | © 2024 Asset Consulting Group. All Rights Reserved.